How to Choose the Best Mortgage Refinancing Options for Your Home

For homeowners, mortgage refinancing can be one of the most impactful financial decisions they make. Whether it’s to lower monthly payments, reduce the term of the loan, access home equity, or consolidate debt, the right refinancing option can provide both immediate relief and long-term savings...

But, before diving into the options available, it’s important to understand what refinancing really means, why it matters, and how it works.

The Basics of Mortgage Refinancing

Mortgage refinancing refers to the process of replacing your current home loan with a new one, typically with different terms. This process is essentially like taking out a new loan to pay off the existing mortgage, but the difference lies in the fact that homeowners use refinancing to achieve specific financial goals.

The idea is simple: If your financial situation has improved, or if market conditions are more favorable, refinancing can help you obtain better terms, save money, or meet other personal financial objectives. For example, if interest rates have dropped since you took out your original mortgage, refinancing may allow you to lock in a lower rate, which means reduced monthly payments and significant savings over the life of the loan.

However, just because refinancing is available doesn’t mean it’s always the right option for everyone. The decision to refinance should take into consideration your financial goals, current loan terms, the state of the real estate market, and your long-term plans for the home. Refinancing comes with costs, and in some cases, it may take years to break even and see significant benefits.

Why This Matters

Understanding mortgage refinancing is crucial because it empowers homeowners to make informed decisions. The landscape of mortgage loans is constantly evolving, with new products, interest rates, and options available all the time. Without a clear understanding of how refinancing works, homeowners might miss out on opportunities or make decisions that ultimately cost them more money.

Refinancing isn’t always about saving money, either. For some homeowners, it could be about accessing home equity for personal reasons like funding a major life event, consolidating debt, or financing home improvements. Others might refinance to lock in a fixed-rate mortgage to provide stability, especially when dealing with an adjustable-rate mortgage (ARM) that’s set to increase.

In short, understanding refinancing lays the foundation for making the best choices about your home and your financial future. Now, let’s take a deeper look at what mortgage refinancing is, how it works, and why you might want to consider it.

What is Mortgage Refinancing and How Does It Work?

At its core, mortgage refinancing is a process that allows homeowners to replace their existing mortgage loan with a new one. The goal of refinancing is usually to secure better terms whether that’s a lower interest rate, a different loan type, or more favorable payment structures. Here’s a breakdown of how mortgage refinancing works.

The Process of Refinancing Your Mortgage

Refinancing begins with a review of your existing mortgage. Just like when you first applied for your original mortgage, you’ll need to gather documentation and go through a similar application process. The basic steps involved in refinancing are as follows:

Assess Your Current Mortgage Terms: Before you begin the refinancing process, take a close look at your current mortgage. What interest rate do you have? Is your mortgage fixed or adjustable? What is your remaining balance, and how many years are left on the loan? These details will play a huge role in deciding whether refinancing makes sense for you.

Evaluate Your Financial Situation: Lenders will look at your credit score, debt-to-income ratio, and the amount of equity in your home. You’ll need to provide financial documents like tax returns, bank statements, and proof of income. This is an important step because your creditworthiness will influence your new loan’s interest rate and terms.

Find a Lender and Apply for Refinancing: Once you’ve evaluated your current loan and your financial situation, it’s time to shop around for a lender. Compare interest rates, closing costs, and loan terms. Many lenders offer refinancing options, so it’s a good idea to get quotes from multiple sources.

Loan Approval Process: After applying for refinancing, the lender will review your application and run a credit check. They’ll assess your financial health and the value of your home to ensure they’re comfortable lending to you. If approved, you’ll receive a loan estimate that outlines the new terms.

Close on the New Loan: After receiving approval, you’ll go through a closing process similar to the one when you first purchased your home. This involves paying closing costs, signing the new mortgage documents, and receiving the funds to pay off your old loan.

Pay Off the Old Loan: Once the new loan is finalized, the proceeds from the refinance will go directly to paying off your current mortgage. From there, your new mortgage terms take effect, and you’ll start making payments on your refinanced loan.

Key Terms to Understand in the Refinancing Process

Loan-to-Value Ratio (LTV): This is the ratio of your current mortgage balance to the appraised value of your home. Lenders use this figure to determine the level of risk they’re taking on. A lower LTV ratio typically means you have more equity in your home, which is generally a good sign for lenders.

Closing Costs: Just like your original mortgage, refinancing comes with associated fees and costs, including loan application fees, appraisal fees, and title insurance. These can vary depending on your lender and the type of loan you're refinancing into.

Interest Rate: Refinancing offers the opportunity to secure a new interest rate. A lower rate can reduce your monthly payment and overall loan costs, while a higher rate could increase your expenses.

In essence, mortgage refinancing works in much the same way as the original mortgage process, but the goal is to restructure the loan to better suit your current financial situation and goals.

Why Should You Consider Refinancing Your Mortgage?

Refinancing isn’t just about reducing your interest rate; it can be a strategic tool for meeting broader financial objectives. While the primary motivation for many homeowners is the potential for savings, there are several reasons why refinancing might be a good decision, depending on your individual circumstances.

1. Lower Interest Rates

One of the most common reasons people refinance is to take advantage of lower interest rates. If interest rates have dropped since you first obtained your mortgage, refinancing can allow you to lock in a new rate, which often results in lower monthly payments. Over the course of a 15 or 30-year mortgage, this can amount to substantial savings.

For example, if you have a $300,000 mortgage at 5% interest and you refinance to 3.5%, you could save thousands of dollars over the life of the loan. The difference in monthly payments might seem small at first, but when compounded over years, the total savings can be significant.

2. Lower Monthly Payments

Another reason to refinance is to lower your monthly payment. This can be particularly helpful if you’re struggling with cash flow or if you want to free up money for other financial goals. Refinancing into a lower interest rate or extending the loan term (e.g., from 15 years to 30 years) can lower your monthly obligations.

However, it’s important to remember that while lowering your monthly payments might offer short-term relief, extending the loan term can also increase the total interest paid over the life of the loan. Therefore, it’s critical to balance your desire for lower monthly payments with your long-term financial goals.

3. Shorten Your Loan Term

On the flip side, refinancing to a shorter loan term can allow you to pay off your mortgage faster, saving you money on interest over the life of the loan. If you can afford higher monthly payments, refinancing to a 15-year mortgage (from a 30-year term) can help you pay off your mortgage faster, often with a much lower interest rate. This means that while your payments might increase, you’ll pay off your mortgage in half the time and significantly reduce the amount of interest paid.

4. Accessing Home Equity

For homeowners who have built up substantial equity in their homes, refinancing provides a way to access that equity. Through a cash-out refinance, you can take out a new mortgage for more than what you owe on the home and receive the difference in cash. This cash can be used for a variety of purposes, including funding home improvements, consolidating high-interest debt, or financing education expenses.

While a cash-out refinance can be a useful tool, it’s important to be cautious. Taking out too much equity can put you at risk if the housing market declines, and it can lead to a higher loan balance than originally intended. Always ensure that the reasons for tapping into your home equity align with long-term financial stability.

5. Switching Loan Types

If you have an adjustable-rate mortgage (ARM), refinancing can allow you to switch to a fixed-rate mortgage, providing stability and predictability in your payments. An ARM can be tempting due to initially lower rates, but as interest rates rise, your payments could increase substantially. Refinancing into a fixed-rate mortgage can help you lock in a stable interest rate, providing peace of mind if market conditions become unpredictable.

On the other hand, if you have a fixed-rate mortgage and you anticipate interest rates will decrease, refinancing to an ARM might save you money in the short term. The right move depends on your tolerance for risk and your understanding of where interest rates are headed in the future.

Types of Mortgage Refinancing Options Available

When considering refinancing, it's essential to understand the different types of refinancing options available, as each one is tailored to specific financial needs. Choosing the right type can make a significant difference in the terms of your new loan and the long-term financial impact.

1. Rate-and-Term Refinance

A rate-and-term refinance is the most straightforward type of refinance. It involves refinancing your existing mortgage for a new loan that has a lower interest rate or a different loan term. For example, you might refinance your current 30-year mortgage into a 15-year loan with a lower interest rate.

This type of refinancing can be beneficial if you’re looking to save money on interest or shorten the length of your loan. The primary goal here is to change the rate or the term (or both) of your current mortgage to better align with your financial situation.

2. Cash-Out Refinance

A cash-out refinance allows you to take out a new loan for more than you owe on your current mortgage. The difference between the original mortgage balance and the new loan is provided to you in cash. Homeowners typically use this cash for large expenses such as home renovations, debt consolidation, or other financial goals.

Cash-out refinancing can be a great way to leverage the equity in your home, but it’s crucial to be mindful of the risks. If you’re not careful, you could end up with a higher mortgage balance than you initially started with.

3. Cash-In Refinance

A cash-in refinance involves paying down your mortgage balance in order to reduce your loan-to-value (LTV) ratio. Homeowners might choose a cash-in refinance if they want to lower their monthly payments, qualify for a lower interest rate, or avoid paying private mortgage insurance (PMI).

This type of refinance is less common but can be a good option for homeowners who have accumulated enough savings or received a windfall that they can apply to their mortgage.

4. Streamline Refinance

Streamline refinancing is a simplified refinance option available through certain government-backed loans, such as FHA or VA loans. Streamline refinances typically require less documentation and no home appraisal. These loans are intended to make refinancing easier and more accessible, especially for borrowers who are current on their payments.

While streamline refinances don’t allow for cash-out options, they can help reduce monthly payments or adjust loan terms with minimal paperwork.

5. Adjustable-Rate Mortgage (ARM) Refinance

Some homeowners may choose to refinance into an adjustable-rate mortgage (ARM), especially if they anticipate lower rates in the future. ARMs typically start with a lower initial interest rate than fixed-rate mortgages, but the rate will change over time, usually after an introductory period.

This type of refinancing can be ideal for borrowers who plan to sell or refinance again before the interest rate adjusts.

Assessing Your Financial Goals Before Refinancing

Before jumping into the refinancing process, it’s essential to assess your financial goals. Refinancing should align with your short-term and long-term financial plans. Without clear goals, you might end up with terms that don’t truly benefit your overall financial picture.

1. Clarify Your Objectives

Start by asking yourself: Why do I want to refinance? Your answer could range from lowering your monthly payment to paying off your mortgage faster or accessing home equity for other uses. Being clear about your reasons will guide you in choosing the right type of refinance.

For example, if your primary goal is to lower your monthly payments, a longer-term mortgage with a lower interest rate might be the best option. If you want to pay off your loan faster, a shorter term with a fixed interest rate might be more suitable.

2. Evaluate Your Current Financial Situation

Take a hard look at your finances. What is your current credit score? Do you have enough equity in your home to refinance? What are your current income and expenses? These factors will not only influence your ability to qualify for refinancing but will also play a role in the type of loan you qualify for.

Understanding Your Credit Score and Its Impact on Refinancing

When it comes to refinancing, your credit score plays a crucial role in determining the terms and interest rate you’ll be offered by lenders. A higher credit score generally translates to more favorable terms, while a lower score can limit your options or result in higher rates. Let’s take a deeper dive into how your credit score affects your refinancing journey.

How Lenders Use Your Credit Score

Lenders use your credit score as a measure of your financial reliability and risk. The higher your score, the less risky you appear to them, which means they’re more likely to offer you a loan with lower interest rates. Conversely, a lower credit score suggests that you might be more likely to miss payments or default on the loan, which is why lenders might charge higher rates to offset the potential risk.

Typically, credit scores are divided into ranges:

Excellent (750 or higher): If your score is in this range, you’ll have the best chances of qualifying for the lowest interest rates and the most favorable terms.

Good (700-749): This is still a solid score, and you can likely secure favorable refinancing terms, though not the absolute lowest rates.

Fair (650-699): At this level, refinancing may still be possible, but you might face higher interest rates and more restrictive loan options.

Poor (below 650): Homeowners with scores in this range might find it more challenging to refinance, and they may be offered higher rates or be denied outright.

Why Your Credit Score Matters for Refinancing

Your credit score primarily affects two things in refinancing: the interest rate and the loan approval process.

Interest Rates: The most obvious impact is that your credit score will determine the interest rate you're offered. A low credit score can result in an interest rate that’s much higher than someone with a strong credit score. For example, someone with a credit score of 800 may be offered a 3.25% interest rate, while someone with a score of 620 might face an interest rate of 4.75% or higher.

Loan Approval: Credit scores also impact your ability to qualify for refinancing in the first place. Many lenders have minimum score requirements for refinancing, especially for certain types of loans. If your score falls below the minimum threshold, you may not be able to refinance at all—or you may need to pay a higher interest rate to offset the risk.

How to Improve Your Credit Score Before Refinancing

If your credit score is less than ideal and you’re hoping to refinance, it’s not the end of the road. You can take steps to improve your credit score before applying for refinancing. Some effective ways to boost your credit score include:

Paying Down Debt: Your credit utilization ratio—the amount of debt you have compared to your available credit—can significantly impact your credit score. Paying down credit card balances can improve your score and help you qualify for better refinancing terms.

Making Timely Payments: Ensure that all your bills—especially credit cards, auto loans, and existing mortgages—are paid on time. Your payment history makes up a large portion of your credit score.

Disputing Errors: Sometimes, credit reports contain mistakes that can drag down your score. Obtain a free copy of your credit report from the three major bureaus (Experian, Equifax, and TransUnion) and dispute any inaccuracies.

Limiting New Credit Applications: Each time you apply for new credit, your score takes a hit. Avoid applying for new loans or credit cards before refinancing, as too many inquiries can lower your score.

The Bottom Line

Your credit score is a critical factor in securing favorable refinancing terms. If your score is less than optimal, consider taking the time to improve it before refinancing. The difference in interest rates can be substantial, and a higher score can help you save thousands over the life of the loan.

How to Evaluate Your Current Mortgage Terms

Before deciding to refinance, it’s important to carefully evaluate your current mortgage terms. This involves understanding your existing loan structure and identifying how refinancing could benefit you. Let’s walk through the key factors to review and consider.

1. Interest Rate

Start by reviewing your current interest rate. If interest rates have dropped significantly since you originally obtained your mortgage, refinancing could be an excellent opportunity to lock in a lower rate. However, if your current rate is already low (e.g., below 3.5%), refinancing might not offer substantial savings.

For example, let’s say you have a 30-year mortgage with a 4.5% interest rate and you’re able to refinance to 3%. That’s a reduction of 1.5%—which can make a significant difference over time. However, if your current rate is already close to 3% or lower, refinancing might not make sense unless you can shorten your loan term or access equity.

2. Loan Term

Next, evaluate the term of your existing loan. Is it a 15-year or a 30-year mortgage? Refinancing gives you the option to either extend or shorten your loan term, depending on your financial goals.

Extending the Loan Term: Refinancing into a longer-term mortgage (such as going from a 15-year to a 30-year loan) will generally lower your monthly payments. This might be helpful if you’re struggling with cash flow, but keep in mind that extending the term also means you’ll pay more interest over the life of the loan.

Shortening the Loan Term: Refinancing into a shorter-term mortgage can increase your monthly payments, but it can save you significant money in the long run by reducing the amount of interest you’ll pay. For example, moving from a 30-year mortgage to a 15-year mortgage might result in a higher payment, but you’ll pay off the loan much quicker and save on interest costs.

3. Loan Balance and Home Equity

Next, assess the remaining balance on your mortgage and the equity you’ve built in your home. The equity in your home is the difference between its market value and your outstanding mortgage balance. A higher equity percentage can open up more refinancing options, especially if you’re considering a cash-out refinance.

If you’ve built up a lot of equity, refinancing may allow you to access some of that equity for home improvements or other financial needs. However, if your home equity is low (for example, if you’re still paying off a significant portion of your loan), refinancing may not be as beneficial.

4. Loan Type (Fixed vs. Adjustable)

Consider the type of mortgage you currently have. Is it a fixed-rate mortgage (FRM), or is it an adjustable-rate mortgage (ARM)? An ARM can be advantageous when interest rates are low, but it carries the risk of increasing payments if rates rise in the future.

If you have an ARM and are concerned about potential rate increases, refinancing into a fixed-rate mortgage can offer more stability. On the other hand, if you have a fixed-rate mortgage and interest rates are dropping, refinancing into an ARM might allow you to take advantage of lower rates in the short term.

5. Private Mortgage Insurance (PMI)

If you initially put less than 20% down on your home, you may be paying for private mortgage insurance (PMI). PMI can add a significant amount to your monthly payment. If your home’s value has increased or you’ve paid down your mortgage enough to have 20% or more equity, refinancing might allow you to remove PMI, which could lower your payments.

6. Remaining Loan Term

How much time do you have left on your current mortgage? If you’re nearing the end of your mortgage term and have only a few years left to pay off the loan, refinancing might not be worth it. In this case, the cost of refinancing (including closing costs and fees) might outweigh the benefits of reduced monthly payments.

The Role of Interest Rates in Refinancing Decisions

Interest rates are perhaps the single most important factor in the refinancing process. They directly influence your monthly mortgage payments and determine the overall cost of your loan. But how do you know when to refinance based on interest rate movements, and what role do rates play in your decision?

How Interest Rates Impact Your Monthly Payment

Interest rates determine how much you’ll pay in interest over the life of the loan. For example, on a $300,000 mortgage, even a small change in the interest rate can result in significant savings or additional costs over time.

Lower Rates: If rates are lower than your current rate, refinancing can reduce your monthly payment or shorten your loan term. A lower rate means you’ll pay less in interest, which can result in savings over the long run.

Higher Rates: If rates have risen since you took out your original mortgage, refinancing may not be beneficial unless you’re refinancing for other reasons (such as consolidating debt or accessing equity). If rates have increased, refinancing into a higher rate will raise your monthly payment.

How to Time Your Refinancing Based on Interest Rates

The key to refinancing is timing it right. Ideally, you want to refinance when rates are at a historic low or significantly lower than what you’re currently paying. This allows you to lock in a low rate and maximize your savings.

However, predicting interest rates can be challenging. They are influenced by numerous factors, including inflation, economic growth, and Federal Reserve policies. While experts can provide guidance, predicting the perfect time to refinance can be difficult.

Short-Term vs. Long-Term Impact

When evaluating whether refinancing makes sense based on interest rates, it’s also important to consider the long-term impact of your decision. For example, even if interest rates are slightly lower, refinancing might not result in meaningful savings if the new loan term is extended, or if you have significant refinancing costs.

If you refinance and lock in a low interest rate, but you still have 25 years left on your mortgage, you may save more money in the long run compared to refinancing for a lower interest rate but extending the loan term to 30 years.

When Is the Best Time to Refinance Your Mortgage?

Knowing the right time to refinance is key to ensuring that you’re getting the most out of the process. Timing your refinance involves both market conditions (such as interest rates) and personal circumstances.

1. When Interest Rates Are Low

The most obvious time to refinance is when interest rates are at historically low levels. If the rates are lower than what you currently have on your mortgage, refinancing can help you lock in a lower rate, reducing both your monthly payments and the total interest you’ll pay over the life of the loan. Generally, a rate decrease of 1% or more from your current mortgage rate could be a good time to refinance.

2. When Your Credit Score Improves

If your credit score has improved since you first took out your mortgage, you might be able to refinance at a better rate. An improvement in your credit score could make a significant difference in the interest rates you’re offered. If your score has improved by 50 points or more, refinancing may provide substantial benefits.

3. When You Build Sufficient Home Equity

Another good time to refinance is when you've built enough equity in your home—typically at least 20%—to avoid paying private mortgage insurance (PMI). Building equity can also open up more refinancing options, including cash-out refinancing, if you need to tap into your home’s value for other financial goals.

4. When You Plan to Stay in Your Home Long-Term

Refinancing often comes with closing costs and fees, so it's more beneficial if you plan to stay in your home for a few more years. If you refinance into a lower rate but plan to sell the home within the next year or two, you may not see enough savings to justify the cost of refinancing.

5. When You Have the Financial Stability for a Refinance

Refinancing may also be an ideal time when you have stable income, a good credit score, and sufficient savings to cover any potential closing costs. Ensure you’re in a strong financial position before refinancing.

The Refinancing Process: Step-by-Step Guide

Now that you’ve assessed your financial situation and understand the various factors involved in refinancing, here’s a step-by-step guide to the process.

Step 1: Assess Your Current Mortgage and Financial Situation

Before beginning the refinancing process, review your current mortgage terms, credit score, and financial goals. This will help you determine the type of refinancing you need and whether it makes sense for your situation.

Step 2: Shop Around for Lenders and Loan Options

Once you’ve evaluated your current mortgage and determined that refinancing is the right choice, the next step is to shop around for lenders. Different lenders offer various refinancing options, so it’s important to get quotes from multiple sources to ensure you’re getting the best deal.

Compare Interest Rates: The first thing you’ll want to compare is the interest rate offered by each lender. Rates can vary significantly from one lender to another, so even a small difference can translate into big savings over the life of the loan. Ask lenders to provide a detailed breakdown of the rate they offer and how it compares to your current rate.

Consider Loan Terms: In addition to the interest rate, compare the loan terms (i.e., the length of the mortgage). Would you be better off with a shorter term, even if it means a higher monthly payment? Or would you prefer a longer-term loan that keeps your monthly payments lower?

Look at Fees and Closing Costs: Refinancing typically involves fees, such as application fees, loan origination fees, and closing costs. Make sure you understand the costs associated with each option before proceeding. Some lenders may offer “no-cost” refinances, where the costs are rolled into the loan amount, but it’s important to calculate whether this option makes sense in the long term.

Review Customer Service and Lender Reputation: Don’t just look at the numbers—consider the reputation and customer service of each lender. Check online reviews, ask for recommendations from family and friends, and ensure that you feel comfortable communicating with the lender throughout the process.

Step 3: Submit Your Application

Once you’ve chosen a lender, the next step is to submit your application. This process typically involves providing a variety of financial documents, including:

Proof of Income: Most lenders will require recent pay stubs, tax returns, or bank statements to verify your income.

Credit Report: The lender will likely check your credit score to assess your eligibility for refinancing. If you’ve improved your credit score since you first took out the loan, you may qualify for a better interest rate.

Home Appraisal: Some types of refinancing, especially cash-out refinancing, may require a home appraisal to assess the current value of your property. While certain types of loans (like FHA Streamline refinances) might not require an appraisal, most lenders will want to ensure the home’s value is enough to secure the loan.

Personal Identification Documents: You’ll likely need to provide proof of identity, such as a government-issued ID or Social Security number.

The lender will also ask you to sign consent forms so they can pull your credit report and verify your employment and income.

Step 4: Lock in Your Interest Rate

Once you’ve completed your application, the lender may offer you the option to lock in your interest rate. Rate locks are typically valid for 30 to 60 days, depending on the lender, and they guarantee that your rate will not change during that period.

Locking in your rate is a good idea if you’re confident that interest rates are unlikely to drop further. If rates are on the rise, locking in your rate can protect you from higher costs down the road. However, if rates are expected to fall, you may want to wait before locking in a rate—though there’s always a risk involved with timing the market.

Step 5: Underwriting and Approval

Once the lender has received all of your documentation and your rate is locked in, they will begin the underwriting process. During underwriting, the lender will thoroughly review your financial situation, credit score, and the home’s appraisal (if applicable). They will also assess your ability to repay the loan based on your debt-to-income ratio.

The underwriting process can take anywhere from a few days to several weeks, depending on the complexity of your application and how quickly you provide any requested documents.

Conditional Approval: If the underwriter is satisfied with the information you’ve provided, they will issue a conditional approval. This means that the lender is willing to move forward with your loan but may require additional documentation or information before issuing the final approval.

Final Approval: Once all conditions are met, the lender will issue a final approval. At this point, you will be provided with the final loan details, including the interest rate, loan term, and monthly payment.

Step 6: Closing the Loan

Once you’ve received final approval, it’s time to close the loan. Closing is the final step in the refinancing process and involves signing the loan documents and paying any remaining fees or closing costs.

Review the Closing Disclosure: Before closing, the lender will provide a closing disclosure, which outlines all the fees, costs, and terms of the loan. Review this document carefully to ensure there are no surprises.

Sign the Loan Documents: At the closing, you’ll sign the loan documents, which include the mortgage note, deed of trust, and any other documents required by your lender. If you’re doing a cash-out refinance, you will also receive the proceeds in the form of a check or direct deposit.

Pay Closing Costs: Closing costs typically range from 2% to 5% of the loan amount, depending on the type of refinance and your lender. Some of these costs may be rolled into the loan, while others must be paid upfront.

Step 7: Begin Your New Mortgage

Once all the paperwork is signed and the funds are distributed, you’ll officially have a new mortgage. From this point forward, you’ll begin making payments based on the terms of the new loan. Make sure to review your new payment schedule and ensure that your monthly payment reflects the changes you expected.

Understanding Closing Costs and Fees

When refinancing your mortgage, one of the most important factors to consider is the closing costs and fees associated with the process. While refinancing can offer long-term savings through lower monthly payments or a better interest rate, these upfront costs can add up quickly and affect your overall savings. Let’s dive into what you can expect and how to manage these expenses.

What Are Closing Costs?

Closing costs are the fees and expenses you pay to finalize the refinancing transaction. These costs typically range from 2% to 5% of the loan amount, so they can add up quickly, especially on larger loans. The exact amount will depend on the lender, the loan type, and your specific financial situation.

Common closing costs and fees associated with refinancing include:

Loan Origination Fee: This is a fee charged by the lender to process your new loan. It can vary widely depending on the lender but usually ranges from 0.5% to 1% of the loan amount.

Appraisal Fee: Many refinances, especially those involving cash-out options, require a home appraisal to determine the current market value of your property. Appraisal fees typically range from $300 to $600, but they can be higher in some markets.

Title Search and Title Insurance: A title search is necessary to ensure there are no outstanding liens or claims on your property. Title insurance protects the lender in case any legal issues arise with the ownership of the property. These fees can range from $500 to $1,500.

Inspection Fees: If you’re refinancing through a government-backed program (such as an FHA or VA loan), you may need a home inspection to assess the condition of the property. Inspections typically cost between $200 and $500.

Attorney Fees: In some states, attorneys are required to be present at the closing process. Attorney fees can range from $300 to $1,000, depending on the complexity of the transaction.

Credit Report Fee: Lenders will often charge a fee to pull your credit report, which typically costs around $30 to $50.

Recording Fees: These are fees associated with recording the new mortgage in public records. Recording fees can range from $50 to $200, depending on your location.

Prepaid Costs: Prepaid costs include things like property taxes, homeowner’s insurance, and mortgage interest. These costs are usually prorated, and you may need to pay some of them upfront at closing.

How to Minimize Closing Costs

While closing costs can be significant, there are several ways you can reduce them or make them more manageable.

Shop Around: Not all lenders charge the same fees. By comparing multiple lenders, you can find one with lower fees or one that offers better terms overall.

Ask About No-Cost Refinancing: Some lenders offer "no-cost" refinancing, where the closing costs are rolled into the new loan balance. While this can reduce your out-of-pocket costs at the time of closing, it may result in a higher interest rate or loan balance.

Negotiate Fees: Don’t be afraid to negotiate with lenders. Some fees, like the loan origination fee or processing fee, may be negotiable. It’s worth asking if there’s any room for flexibility, especially if you have a strong credit score and a good financial standing.

Consider the Long-Term Impact: Keep in mind that while paying a higher upfront cost can seem daunting, it may be worth it in the long run if it helps you secure a much lower interest rate or better loan terms.

Are Closing Costs Worth the Investment?

The value of refinancing often comes down to whether the savings outweigh the closing costs. A good rule of thumb is to calculate the break-even point—the point at which the savings from refinancing surpass the upfront costs. For instance, if you’re paying $5,000 in closing costs and you save $200 a month by refinancing, it will take you 25 months (or a little over 2 years) to break even. After that point, the savings are all profit.

Before committing to refinancing, consider how long you plan to stay in the home. If you’re planning to move within a few years, refinancing may not be worth the upfront costs. But if you plan to stay long-term, refinancing can provide significant financial benefits.

Final Thoughts on Closing Costs

Closing costs are an inevitable part of refinancing, but they shouldn’t deter you from pursuing it if the benefits outweigh the costs. Take the time to understand what’s involved, and always ask for a detailed breakdown of the costs before you sign any agreements. By doing so, you’ll be better prepared to make an informed decision and potentially save thousands of dollars in the process.

Choosing the Right Lender: What to Look For

Selecting the right lender is a critical part of the mortgage refinancing process. The lender you choose will not only impact the interest rate and loan terms but also affect your overall experience throughout the process. Here are some important factors to consider when evaluating potential lenders for your refinance.

1. Reputation and Reviews

Start by researching the reputation of the lender. It’s important to choose a lender with a solid track record, as you’ll be trusting them with one of your most significant financial decisions. Look for customer reviews, both online and from trusted sources such as friends or family, to get a sense of the lender’s reliability and customer service.

Online Reviews: Websites like Google Reviews, Trustpilot, or the Better Business Bureau (BBB) offer feedback from real customers. Pay attention to recurring positive or negative comments, especially regarding the refinancing process, fees, and responsiveness.

Word of Mouth: Ask family, friends, or colleagues if they’ve worked with any lenders recently and what their experiences were like. Personal referrals can be invaluable in finding trustworthy lenders.

Accreditation: Ensure that the lender is accredited by relevant organizations, such as the National Mortgage Licensing System (NMLS), which ensures that lenders adhere to strict industry standards.

2. Interest Rates and Terms

Interest rates are one of the most important factors when choosing a lender, but they shouldn’t be the only factor. A lender with a slightly higher interest rate may offer more favorable loan terms, better customer service, or lower fees, all of which contribute to the overall value of the refinancing package.

Rate Comparisons: Be sure to compare the interest rates and loan terms offered by multiple lenders. Even a small difference in rates can have a significant impact over the life of the loan. Ask each lender for a Loan Estimate (LE)—this will provide a detailed breakdown of the interest rate, monthly payments, and fees associated with the loan.

Type of Loan Offered: Different lenders specialize in different types of loans. Some may be more experienced with government-backed loans like FHA or VA, while others may offer conventional loans with favorable terms for borrowers with higher credit scores. Make sure the lender you choose offers the type of loan that best fits your needs.

3. Customer Service and Support

Refinancing can be a lengthy and sometimes complicated process, so you’ll want to work with a lender that provides excellent customer support. A lender who is responsive, transparent, and willing to explain things in detail can make the process much smoother and less stressful.

Communication: Pay attention to how quickly a lender responds to your inquiries. Do they provide clear and timely updates throughout the process? Good communication is essential, especially if you run into any issues during the refinancing process.

Education and Guidance: The best lenders will take the time to explain your options and help you understand the pros and cons of different loan terms. They should be patient and willing to answer any questions you have, no matter how basic they may seem.

Support Team: Ask about the support team that will be handling your refinance application. Will you be dealing with a loan officer, a processor, or both? Make sure there is a clear point of contact throughout the process.

4. Fees and Costs

Fees can vary significantly from one lender to another, so it’s important to understand the full cost of refinancing before you sign any agreements. Ask lenders for a detailed breakdown of all the fees involved in the refinance process, including:

Loan Origination Fees: Some lenders charge a fee for processing the new loan. This can vary greatly, so be sure to compare.

Appraisal Fees: Depending on the lender, you may be required to pay for an appraisal to assess the home’s value.

Closing Costs: Be sure to get an estimate of all the closing costs involved, so you aren’t blindsided by extra charges.

5. Loan Options

Different lenders may offer different loan products. If you’re looking for flexibility, make sure the lender provides a variety of options, such as fixed-rate mortgages, adjustable-rate mortgages (ARMs), or government-backed loans (FHA, VA, or USDA loans).

The Importance of Refinancing with a Reliable Lender

Choosing a reliable lender is perhaps the most important decision when refinancing your mortgage. Refinancing is a significant financial move that involves a substantial amount of money, time, and effort. If you work with an unreliable lender, it could lead to a host of complications, including higher fees, delayed timelines, or even the risk of losing your home.

Why Reliability Matters

When refinancing, you’re trusting a lender to guide you through the entire process—from gathering documents to closing the loan. A reliable lender will ensure that the process is smooth and transparent. They will communicate with you regularly, answer any questions you have, and make sure you understand the terms and fees before you sign anything.

Additionally, a reliable lender will work to get you the best terms available. They will evaluate your financial situation carefully and present the loan options that make the most sense for your specific needs.

Refinancing with Government-Backed Programs

Refinancing through government-backed programs can be an excellent option for homeowners who may not qualify for traditional loans. These programs are designed to assist borrowers by offering more favorable terms, lower interest rates, and reduced qualification requirements. If you’re eligible for any of these programs, it could be the right solution for your refinancing needs.

Types of Government-Backed Refinancing Programs

There are three major types of government-backed refinancing programs in the United States: FHA, VA, and USDA. Let’s take a look at each of these to understand their benefits and requirements.

1. FHA Streamline Refinancing

The Federal Housing Administration (FHA) offers a streamlined refinancing program that is designed for homeowners with FHA loans who want to refinance into a lower interest rate. This program simplifies the refinancing process, as it requires less documentation, fewer qualification requirements, and no appraisal in most cases.

Benefits of FHA Streamline Refinancing:

No Appraisal Required: One of the biggest benefits is that FHA Streamline refinances usually don’t require a home appraisal, which can save you time and money.

Lower Credit Score Requirements: The FHA Streamline program is more lenient when it comes to credit score requirements, making it easier for homeowners with less-than-perfect credit to qualify.

Reduced Documentation: Since this program is aimed at existing FHA borrowers, the documentation requirements are generally less stringent than for a traditional refinance.

Faster Processing Time: Because the process is streamlined and less paperwork is needed, the refinancing process can be completed more quickly than traditional refinancing.

Drawbacks:

Limited to FHA Loans: The FHA Streamline refinance program is only available to borrowers who already have an FHA loan. If your loan is not FHA-backed, you’ll need to look at other refinancing options.

No Cash-Out Option: FHA Streamline refinances do not allow you to take out any cash from your home’s equity. If you need to access cash for home improvements or other financial needs, you’ll need a different type of refinance.

2. VA Streamline Refinancing (IRRRL)

The VA Streamline Refinancing program, also known as the Interest Rate Reduction Refinancing Loan (IRRRL), is available to active-duty military members, veterans, and eligible surviving spouses. This program allows you to refinance your existing VA loan to take advantage of lower interest rates and better terms.

Benefits of VA Streamline Refinancing:

No Appraisal or Income Verification: One of the standout benefits of the VA IRRRL is that it typically doesn’t require an appraisal or income verification, making the process easier and faster.

No Closing Costs: Many VA Streamline refinances come with no closing costs, which means you can refinance without paying anything upfront. However, keep in mind that these costs may be rolled into the loan balance.

Lower Interest Rates: VA loans generally offer lower interest rates than conventional loans, and the IRRRL allows veterans and military families to lock in even better rates.

Drawbacks:

Limited to VA Borrowers: Like the FHA Streamline, the VA IRRRL is only available to homeowners who currently have a VA loan. If you have a conventional or FHA loan, you won’t be eligible for this program.

Not for Cash-Out Refinances: The VA Streamline program doesn’t allow you to access home equity for other expenses. If you want to tap into your home’s equity, you’ll need a different type of refinance.

3. USDA Rural Refinance Pilot Program

The United States Department of Agriculture (USDA) offers a refinancing program for homeowners with USDA loans. This program is aimed at rural homeowners, with eligibility typically determined by location and income level. The USDA Rural Refinance Pilot Program allows eligible homeowners to refinance their existing USDA loans into lower-interest loans.

Benefits of USDA Refinancing:

No Appraisal Needed: Similar to the FHA and VA programs, USDA refinancing often doesn’t require an appraisal, saving you time and money.

Lower Interest Rates: USDA loans often offer lower interest rates compared to conventional loans, and refinancing through the program can help reduce your monthly payment.

Streamlined Process: The USDA refinancing program is designed to be more straightforward, with fewer documentation requirements than traditional refinancing.

Drawbacks:

Rural Location Requirements: To qualify for USDA refinancing, your property must be located in a designated rural area. This program is not available in urban or suburban areas.

Income Limits: The USDA refinancing program has income limits, so it’s only available to borrowers who meet specific income requirements based on family size and location.

Choosing the Right Government Program

The right government-backed program depends on your current loan, your eligibility, and your financial goals. If you’re a veteran, the VA IRRRL might be the best choice for you, while homeowners with FHA loans may benefit from the Streamline Refinance. If you live in a rural area and have a USDA loan, refinancing through that program could offer substantial savings.

Government-backed programs offer excellent opportunities for homeowners to refinance with favorable terms and reduced costs. However, be sure to carefully evaluate the eligibility requirements and determine whether the program you’re interested in is the best fit for your financial situation.

Refinancing with a Fixed-Rate Mortgage: Pros and Cons

When refinancing your mortgage, one of the most common choices is to opt for a fixed-rate mortgage. Fixed-rate mortgages offer stability and predictability, but they may not always be the best fit for every borrower. Let’s explore the pros and cons of refinancing into a fixed-rate mortgage.

What Is a Fixed-Rate Mortgage?

A fixed-rate mortgage is a loan in which the interest rate remains the same for the entire term of the loan, whether it's 15, 20, or 30 years. This means that your monthly payment for both the principal and interest will remain the same for the life of the loan, providing a stable and predictable payment schedule.

Pros of Refinancing with a Fixed-Rate Mortgage

1. Predictability and Stability

One of the most significant benefits of a fixed-rate mortgage is the predictability it offers. With a fixed interest rate, you’ll know exactly how much your mortgage payment will be each month, which can make budgeting and financial planning easier. There’s no need to worry about fluctuations in interest rates that can impact your payments, as is the case with adjustable-rate mortgages (ARMs).

2. Protection Against Rising Interest Rates

Refinancing into a fixed-rate mortgage locks in your interest rate for the duration of the loan term. This provides protection against future interest rate hikes. In times of economic uncertainty or rising interest rates, having a fixed-rate mortgage can be reassuring, as you’ll continue to pay the same amount regardless of what happens in the broader market.

3. Long-Term Savings

If you refinance at a lower fixed rate than your current mortgage rate, you can save money over the life of the loan. This is especially true if you refinance into a 15-year mortgage with a lower rate, which can help you pay off your loan faster and reduce the overall interest you pay.

4. Increased Equity Building

With a fixed-rate mortgage, you have the option of refinancing into a shorter loan term, such as a 15-year fixed mortgage. A shorter term typically means higher monthly payments, but it also means you’ll pay off your mortgage faster and build equity more quickly.

5. No Surprises

Since your payment remains fixed, you don’t have to worry about unexpected increases in your mortgage payment. This is particularly important if you have a tight budget or are planning to stay in your home for a long time.

Cons of Refinancing with a Fixed-Rate Mortgage

1. Higher Initial Interest Rates (Compared to ARMs)

Fixed-rate mortgages typically come with a higher interest rate compared to adjustable-rate mortgages (ARMs), especially if you’re refinancing into a long-term loan (e.g., 30 years). If you refinance into a fixed-rate mortgage with a higher rate than your current loan, you might not see any savings at all, or you could even end up paying more over the long term.

2. Less Flexibility

While a fixed-rate mortgage offers stability, it can be less flexible if your financial situation changes. If interest rates drop significantly after you refinance, you won’t be able to take advantage of lower rates unless you refinance again. On the other hand, an ARM would adjust to reflect changes in the market, possibly giving you a better deal if rates fall.

3. Longer Commitment

Refinancing into a fixed-rate mortgage, especially a long-term one, means that you’re committing to those payments for a long period. If you plan to sell your home or pay off your mortgage early, you may not recoup the refinancing costs as quickly as you would with a shorter-term loan.

4. Potentially Higher Monthly Payments

Depending on your current mortgage balance and the term of the new loan, refinancing into a fixed-rate mortgage may increase your monthly payment, especially if you choose a shorter loan term. While you’ll pay off the loan more quickly, you may find the higher payments strain your budget.

Exploring Adjustable-Rate Mortgages (ARMs) for Refinancing

While fixed-rate mortgages offer predictability and stability, adjustable-rate mortgages (ARMs) can offer lower initial interest rates that may make them an attractive option for some homeowners looking to refinance. However, ARMs come with their own set of advantages and risks, which it’s important to fully understand before making a decision. Let’s take a closer look at ARMs and how they work in the context of refinancing.

What Is an Adjustable-Rate Mortgage (ARM)?

An adjustable-rate mortgage (ARM) is a loan where the interest rate can fluctuate over time based on market conditions. ARMs usually begin with a lower initial interest rate than fixed-rate mortgages, but after a set period, the rate adjusts according to an index that reflects changes in the market. The most common ARMs are 5/1, 7/1, or 10/1, where the first number refers to the number of years the rate is fixed, and the second number indicates how often the rate can adjust after that period (e.g., every year).

For example, a 5/1 ARM offers a fixed rate for the first five years, then adjusts annually after that period. The rate changes based on an underlying benchmark, such as the LIBOR (London Interbank Offered Rate) or SOFR (Secured Overnight Financing Rate), plus a margin added by the lender.

Benefits of Refinancing with an ARM

1. Lower Initial Interest Rates

One of the main advantages of refinancing with an ARM is the lower initial interest rate. Compared to a fixed-rate mortgage, the starting rate on an ARM is usually much lower, which can result in significant savings on monthly payments during the initial fixed-rate period.

This makes ARMs appealing to borrowers who plan to stay in their homes for a short period or want to reduce their monthly payments in the early years of their loan. If you refinance into an ARM, you may find that you can afford a larger loan amount or more desirable property without increasing your monthly payments.

2. Potential for Future Interest Rate Reductions

If market interest rates drop, the interest rate on your ARM will decrease as well, leading to lower monthly payments. In this way, ARMs offer the potential for savings if the overall interest rate environment improves.

For homeowners who expect rates to remain low or decrease in the future, an ARM could be a smart refinancing option, as the adjustments might keep their payments low after the initial fixed-rate period.

3. Lower Monthly Payments at the Start

Because the initial interest rate on an ARM is typically lower than a fixed-rate mortgage, refinancing into an ARM can help reduce your monthly payments—at least in the beginning. This can be particularly beneficial if you need some financial breathing room for a few years, perhaps to pay off other debts or save for future expenses.

4. Flexibility if You Plan to Move Soon

If you plan to sell your home within the first few years, refinancing into an ARM can be a smart move. Since the interest rate is fixed for the initial period, you can enjoy the lower payments for several years before the rate adjusts. This may give you time to take advantage of lower payments without worrying about rate increases.

Risks and Drawbacks of ARMs

1. Interest Rate Increases After the Initial Period

While ARMs offer lower initial rates, the biggest downside is that your payments can increase after the initial fixed period. If market interest rates rise, your interest rate will adjust upwards, and your monthly payment will increase. In some cases, this can lead to significant payment shock, particularly if rates rise significantly during the adjustment period.

For homeowners who expect to stay in their homes for a long period, the eventual rate hikes can result in higher overall payments than they would have had with a fixed-rate mortgage.

2. Uncertainty and Risk

The uncertainty of future interest rates is a major concern with ARMs. While the initial rate might be appealing, it’s impossible to predict how much your payments might increase when the rate adjusts. If you’re risk-averse or planning to stay in your home for the long term, an ARM might feel too uncertain, especially if rates rise sharply.

3. Caps and Limits on Rate Increases

While most ARMs have caps that limit how much the interest rate can increase, these caps are usually set to a maximum rate. If rates rise significantly, you could find yourself paying much higher monthly payments than you initially anticipated. Be sure to read the fine print to understand the cap and the adjustment schedule before refinancing.

4. Potential for Negative Amortization

Some ARMs include provisions that allow for negative amortization, meaning that your monthly payments might not cover the interest due, causing your loan balance to increase over time. This is especially true for loans that allow you to make smaller payments than what’s required. It’s important to check the terms of any ARM refinance to ensure that this feature doesn’t apply.

Is an ARM Right for You?

An adjustable-rate mortgage can be a great option if you plan to stay in your home for only a few years and expect rates to remain low or decrease. However, if you anticipate living in your home for the long term, refinancing into an ARM could expose you to future risks as the rate adjusts upward.

If you decide that an ARM is right for you, it’s essential to carefully consider the terms, caps, and the overall structure of the loan. Make sure you fully understand how and when your rate will adjust and what the potential impact will be on your monthly payment.

How to Maximize Your Home’s Equity in Refinancing

When refinancing your mortgage, one of the most powerful advantages is the ability to leverage your home’s equity to achieve financial goals. Maximizing your home’s equity through refinancing can provide opportunities for lower monthly payments, improved loan terms, and even access to cash for home improvements, debt consolidation, or other major expenses.

Let’s take a look at how you can maximize your home equity when refinancing.

Understanding Home Equity

Home equity is the portion of your home’s value that you actually own, calculated by subtracting your mortgage balance from the current market value of your property. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in home equity.

As you continue to pay off your mortgage and as your home’s value appreciates, your equity increases, giving you more opportunities for refinancing.

1. Consider a Cash-Out Refinance

A cash-out refinance allows you to borrow more than what you owe on your current mortgage and take the difference in cash. This can be a great way to access your home’s equity for purposes such as paying off high-interest debt, funding major home renovations, or even investing in other ventures.

How Cash-Out Refinancing Works:

You refinance your existing mortgage with a new loan for a larger amount than what you currently owe.

The additional funds are provided to you in cash, which you can use however you choose.

Typically, you can borrow up to 80% of your home’s current value in a cash-out refinance. However, the specific amount will depend on the lender’s guidelines, your credit score, and other financial factors.

Benefits of Cash-Out Refinancing:

Access to funds: A cash-out refinance allows you to tap into your home’s equity without taking on additional debt.

Lower interest rates: If you can secure a lower interest rate with the refinance, it may help you reduce your overall debt load.

Debt consolidation: Using the cash from a refinance to pay off high-interest debts (such as credit cards or personal loans) can save you money over time.

Risks of Cash-Out Refinancing:

Higher mortgage payments: Since you’re increasing the loan balance, your monthly mortgage payments will likely rise.

Longer loan term: If you extend the loan term with the refinance, it could take longer to pay off your mortgage, meaning you’ll pay more in interest over time.

Risk of foreclosure: By borrowing against your home equity, you’re putting your property at risk if you’re unable to make the higher mortgage payments.

2. Home Improvements to Increase Equity

If you’re looking to maximize your home’s equity before refinancing, consider making strategic home improvements that increase the value of your property. For example, remodeling the kitchen or bathroom, upgrading the roof, or adding energy-efficient features can increase the overall market value of your home, resulting in more equity available to you when refinancing.

A higher property value means you can borrow more without exceeding the lender’s maximum loan-to-value (LTV) ratio, allowing you to leverage more of your home’s equity.

3. Pay Down Your Mortgage to Increase Equity

Another strategy to maximize your home equity is to pay down your mortgage before refinancing. The more you reduce your outstanding mortgage balance, the more equity you have in your home. This can allow you to secure better refinancing terms and potentially avoid paying private mortgage insurance (PMI) if your equity reaches 20% or more.

4. Monitor Your Home’s Market Value

Home values can fluctuate over time, so it’s important to keep an eye on the market value of your property. If property values in your neighborhood are rising, you might be in a good position to refinance and take advantage of increased equity. Conversely, if values are declining, you may need to wait before refinancing to avoid being upside down on your mortgage (owing more than your home is worth).

Refinancing with a Shorter Loan Term: Is It Worth It?

When refinancing your mortgage, one of the key decisions you’ll face is whether to stick with your current loan term or refinance into a shorter loan term. While refinancing into a shorter term can help you pay off your mortgage more quickly and save money on interest, it’s important to understand the trade-offs and whether it aligns with your financial goals.

The Basics of Refinancing into a Shorter Loan Term

A shorter loan term typically refers to mortgages with terms of 15 years or 20 years instead of the standard 30 years. Refinancing into a shorter term means you’ll be paying off your mortgage in less time, but the monthly payments are typically higher than what you’d pay on a 30-year loan.

For example, let’s say you refinance your existing 30-year mortgage into a 15-year loan. Although your interest rate may be lower, your monthly payment will likely increase because you’re paying off the loan over a shorter period. This might seem like a daunting prospect, but there are several benefits to this approach.

Pros of Refinancing with a Shorter Loan Term

1. Lower Interest Rates

One of the primary benefits of refinancing into a shorter loan term is that you may be able to secure a lower interest rate. Lenders typically offer better rates for shorter-term loans because there’s less risk for them—they’re lending you money for a shorter period. This can significantly reduce the amount of interest you’ll pay over the life of the loan.

For instance, if you refinance from a 30-year loan to a 15-year loan, your interest rate might drop by 0.5% to 1.0%. While this reduces your monthly payment slightly, the real savings come from the reduction in the total interest paid over the life of the loan.

2. Save Money on Interest

Even though your monthly payments will likely increase, refinancing into a shorter term will allow you to save significant money on interest over the life of the loan. With a 15-year loan, for example, you’ll be paying off the loan in half the time, meaning you’ll pay less overall interest.

For example, on a $200,000 mortgage at an interest rate of 3.5%, you’d pay around $122,000 in interest over 30 years. But with a 15-year term at a lower interest rate of 2.5%, your total interest would be closer to $45,000 over the life of the loan. This results in a savings of $77,000 in interest payments.

3. Build Equity Faster

Since you’re paying off the loan more quickly with a shorter-term mortgage, you’ll be building equity in your home at a faster rate. This can be especially beneficial if you plan to sell the home in the future or want to access equity through refinancing or a home equity loan.

4. Debt-Free Sooner

Refinancing into a shorter term means you’ll pay off your home loan faster, making you mortgage-free in less time. While this increases your monthly payment, it also helps you achieve long-term financial freedom much sooner than a 30-year loan would allow.

5. Financial Peace of Mind

For many homeowners, the thought of being debt-free and owning their home outright is incredibly motivating. If you’re looking to live without the burden of mortgage payments in retirement, refinancing into a shorter term can help you reach that goal. Being debt-free in retirement can provide peace of mind and allow you to enjoy your golden years without the stress of monthly payments.

Cons of Refinancing with a Shorter Loan Term

1. Higher Monthly Payments

The biggest downside to refinancing into a shorter loan term is the increase in monthly payments. Since you’re paying off the mortgage in a shorter period, the monthly payment will be significantly higher than what you’d pay on a 30-year loan. This can stretch your budget and may make it difficult to balance other financial priorities, such as saving for retirement or funding your children’s education.

For instance, if you refinance a $300,000 loan at 3.5% interest, your monthly payments for a 30-year mortgage might be around $1,350, while a 15-year loan might require $2,100 per month. This could put a strain on your cash flow, especially if you’re already living paycheck to paycheck.

2. Opportunity Cost

By choosing to refinance into a shorter loan term, you may be diverting money away from other financial goals. The extra money you’re putting toward your mortgage could be used for things like investing, building an emergency fund, or saving for college tuition. This is particularly relevant if you’re not planning to stay in the home for a long time. You’ll need to assess whether the higher payments are worth the benefit of paying off the mortgage sooner.

3. Potential to Stretch Your Budget Too Thin

With a higher monthly payment, you may find yourself struggling to meet other financial obligations, such as credit card bills, personal loans, or saving for retirement. While paying off your mortgage faster might seem appealing, it’s important to ensure that the increase in your mortgage payment won’t lead to financial strain or jeopardize your other financial goals.

Is Refinancing into a Shorter Term Right for You?

Refinancing into a shorter loan term is a great option if you have the financial flexibility to handle higher payments and want to save on interest or pay off your mortgage more quickly. It’s especially beneficial for those who plan to stay in the home long-term and want to build equity faster.

However, if your current financial situation is tight or if you’re not certain about staying in the home for the full term of the loan, you may want to reconsider. It’s important to balance your long-term goals with your current financial needs when making this decision.

Using Refinancing to Pay Off Debt or Finance Major Expenses

One of the most common reasons homeowners choose to refinance their mortgage is to access cash for major expenses, such as home renovations, medical bills, or paying off high-interest debt. If your home has appreciated in value and you’ve built significant equity, refinancing can be a smart strategy to improve your financial situation and fund important life goals.

How Refinancing Can Help Pay Off Debt

Many homeowners struggle with high-interest debt, such as credit card balances, student loans, or personal loans. If you’re in this situation, refinancing your mortgage can provide a way to consolidate that debt and lower your overall interest rate.

When you refinance your mortgage with a cash-out refinance, you take out a new loan that’s larger than your current mortgage balance, and the difference is paid to you in cash. This extra cash can be used to pay off other high-interest debts. Since mortgage interest rates are typically much lower than credit card rates, this strategy can help you save money on interest payments and simplify your finances by consolidating debt into one monthly payment.

Example:

Credit Card Debt: If you have $20,000 in credit card debt with an interest rate of 18%, your monthly payments could be quite high, and it may take years to pay off the balance.

Refinancing: With a cash-out refinance, you could borrow $20,000 from your home equity at a much lower interest rate (say, 3.5%), potentially saving you hundreds of dollars a month in interest payments.

Using Refinancing to Fund Home Improvements

Refinancing can also be a great way to fund major home improvements, such as kitchen remodels, bathroom upgrades, or even adding an extra bedroom or bathroom. By tapping into your home’s equity, you can finance these projects without taking on high-interest loans or using credit cards.

Not only will home improvements increase your enjoyment of your living space, but they can also raise your home’s value, which could be beneficial if you plan to sell in the future. However, it’s important to ensure that the improvements you make will add significant value to your home to justify the cost.

Refinancing for Major Life Expenses

Refinancing can also be used to cover other major life expenses, such as paying for a wedding, financing a child’s education, or covering medical expenses. Using your home’s equity for these purposes can help you manage large expenses without resorting to higher-cost forms of credit.

The Risks of Using Refinancing to Pay Off Debt or Fund Expenses

While using refinancing for debt consolidation or major expenses can be a smart financial move, it’s important to understand the risks involved. Tapping into your home equity means that you’re taking on more debt secured by your property. If you’re unable to make the higher mortgage payments, you could risk foreclosure.

Additionally, using a cash-out refinance to pay off debt doesn’t address the underlying spending habits that may have led to the debt in the first place. It’s important to work on your financial habits to ensure that you don’t fall back into debt after refinancing.

Avoiding Common Mistakes When Refinancing Your Mortgage

Refinancing your mortgage is a significant financial decision that can have long-term consequences. While refinancing can be a great way to reduce your monthly payments or tap into your home’s equity, there are several common mistakes homeowners make during the process. Avoiding these mistakes can help ensure that you get the best deal and make refinancing a successful financial move.

1. Not Understanding Your Loan Terms

One of the most common mistakes homeowners make is failing to fully understand the terms of their new loan. Whether you’re refinancing into a fixed-rate mortgage, an ARM, or a cash-out refinance, it’s essential to fully grasp the loan’s interest rate, repayment schedule, and any potential penalties or fees.

2. Not Shopping Around for the Best Rate

Many homeowners make the mistake of refinancing with the first lender they find, which can lead to missing out on better interest rates or terms. It’s important to shop around and compare offers from multiple lenders to ensure you’re getting the best possible deal. Even a small difference in interest rates can make a big difference over the life of your loan.

3. Failing to Factor in Closing Costs

Refinancing often comes with closing costs, which can range from 2% to 5% of the loan amount. These costs can add up quickly, so it’s essential to factor them into your decision. Make sure that the savings from refinancing outweigh the costs, and understand how long it will take to recoup those costs through lower monthly payments.

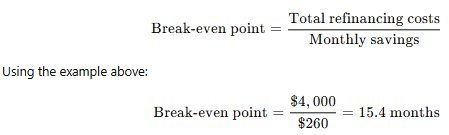

How to Calculate the Break-even Point of Your Refinancing Decision

When considering refinancing your mortgage, one of the most important factors to assess is the break-even point. This is the point at which the savings you gain from refinancing equal the costs associated with refinancing. Understanding this will help you determine if refinancing makes sense, given your specific financial situation.

What is the Break-even Point?

The break-even point in refinancing refers to the length of time it takes for the savings from your new mortgage (lower monthly payments, reduced interest, etc.) to surpass the costs of refinancing, including closing costs, loan fees, and any other associated expenses. If you plan to stay in the home longer than this break-even point, refinancing might make sense. However, if you plan to sell or move before this time, refinancing may not be worth it.

How to Calculate the Break-even Point

To calculate the break-even point of your refinancing decision, you’ll need to follow these steps:

Step 1: Determine Your Refinancing Costs

First, you need to add up the total costs of refinancing. These typically include:

Closing costs (2%-5% of the loan amount)

Application fees

Loan origination fees

Appraisal fees

Title insurance

Attorney fees

Let’s say, for example, that your refinancing costs are $4,000.

Step 2: Calculate Your Monthly Savings

Next, determine how much you will save per month by refinancing. If your current mortgage rate is 5%, and you refinance to a new rate of 3.5%, the difference in monthly payments could be significant. For instance, on a $300,000 mortgage, your monthly payment at 5% might be around $1,610, while refinancing to 3.5% could lower the monthly payment to about $1,350—a savings of $260 per month.

Step 3: Calculate the Break-even Point

To find the break-even point, divide your total refinancing costs by your monthly savings.

So, in this scenario, you would reach the break-even point in about 15 months. After this time, the savings from your lower monthly payments would exceed the refinancing costs.

Step 4: Consider Your Long-Term Plans

Now that you’ve calculated your break-even point, you should consider whether you’ll be in the home long enough to surpass that point. If you plan to sell the home within a few years, refinancing may not be worth it unless you can recoup the refinancing costs quickly. However, if you intend to stay in the home for many years, the savings beyond the break-even point could make refinancing a smart decision.

Other Factors That Could Affect the Break-even Point

In addition to the basic formula, other factors could influence your break-even point, such as:

Changes in interest rates: If market rates increase, you may want to refinance sooner to lock in a low rate before it becomes more expensive.

Length of your loan: If you refinance into a shorter-term loan (like 15 years), your break-even point may be reached sooner due to lower interest costs.

Mortgage insurance: If you’re able to refinance and eliminate PMI (private mortgage insurance), this can provide significant savings that might bring your break-even point closer.

How Long Does It Take to Refinance a Mortgage?

One of the most common questions homeowners have about refinancing is how long it takes. Understanding the timeline of refinancing can help you prepare for the process and ensure that it aligns with your financial and personal goals.

The Typical Refinancing Timeline

While refinancing timelines can vary depending on factors such as lender processing times, market conditions, and the complexity of your application, here’s a general breakdown of the refinancing process:

Step 1: Preparation and Research (1-2 Weeks)

Before you even apply, it’s important to spend some time researching your refinancing options. This could involve:

Evaluating your current mortgage: Review your existing mortgage terms, interest rate, and monthly payments.

Checking your credit score: A higher credit score can help you qualify for a better refinancing rate.

Shopping around: Get quotes from multiple lenders to compare their rates, terms, and closing costs.

Gathering documentation: You’ll need to provide various documents such as proof of income, tax returns, bank statements, and details about your current mortgage.

This step may take 1 to 2 weeks, depending on how quickly you gather the necessary information and make your decision.

Step 2: Application and Approval (3-6 Weeks)

Once you’ve decided to proceed, you’ll submit your refinance application to your chosen lender. The lender will then review your financial profile, your current mortgage, and your property details. Here are the steps involved during this stage:

Lender review: The lender will assess your creditworthiness, income, and home equity.

Appraisal: A home appraisal is usually required to determine the current market value of your property.

Loan underwriting: Your application will be reviewed in detail by the lender’s underwriting department. They’ll confirm your ability to repay the loan and ensure that everything is in order.

This step typically takes 3 to 6 weeks to complete, depending on how quickly the lender can gather all necessary information, schedule the appraisal, and process your application.

Step 3: Closing (1-2 Weeks)

Once your loan is approved, you’ll move to the closing stage, where you’ll sign the necessary documents, finalize the terms, and pay any closing costs.